Many people wonder if a 200k salary truly makes someone rich. It's a question that, quite frankly, pops up a lot when folks talk about money. You see, the idea of being "rich" isn't just about a number on a paycheck; it's a feeling, a lifestyle, and, perhaps, a certain level of financial freedom. So, is that 200,000 figure a golden ticket? It's a bit more nuanced than that, as you will see.

A salary of $200,000, or 200k as it's often written, certainly sounds like a substantial sum to many. It suggests a comfortable life, perhaps with fewer money worries than what some people face. Yet, whether it counts as "rich" can really depend on so many different things. What one person considers a lot, another might view as simply adequate, particularly when considering where they live or their responsibilities. It’s a very interesting point to think about, actually.

This discussion isn't just about the raw number; it's about what that money can do for you, where you are, and what your life looks like. We will explore the various factors that shape how a 200k salary is perceived. It might just change your perspective on what "rich" truly means, more or less.

Table of Contents

- What is 200k, Anyway?

- The Ever-Changing Meaning of "Rich"

- Location, Location, Location: Cost of Living Impacts Everything

- Family Size and Financial Commitments

- Taxes and Other Deductions: The Real Take-Home Pay

- Debt and Financial Goals: Shaping Your Outlook

- Lifestyle Expectations and the Pursuit of More

- When 200k is Just a Single Episode: A Look at Celebrity Earnings

- Beyond the Salary: Wealth and Assets

- Practical Steps for Financial Well-Being

- People Also Ask: FAQs About a 200k Salary

What is 200k, Anyway?

Before we get too far into whether a 200k salary counts as being rich, it's good to be super clear on what that number even means. You know, sometimes people use "k" for thousands, and it can be a little confusing if you are not used to it. So, 200k is just another way of writing the number 200 thousand, which means 200,000. That's it. It's like saying "two hundred thousand," but a bit quicker. Oh, dude, 200k equals 200,000. It's like saying "two hundred thousand." So, if you ever need to sound a little more informed or show off your number skills, that's what it means, anyway.

This shorthand "k" for a thousand comes from the metric system, where "kilo" means a thousand. So, 20k, for example, stands for twenty thousand, or 20,000. It is a simple way to talk about larger amounts without having to write out all the zeros. This way of writing numbers is very common in financial talks, and it's something you will see a lot in articles about money or earnings. Knowing this little detail helps a lot when you are trying to figure out what various figures actually represent, you know?

The Ever-Changing Meaning of "Rich"

The concept of "rich" is not a fixed thing; it moves around a lot, depending on who you ask and what they care about. For some, being rich means having enough money to never worry about bills, ever. For others, it might mean having the freedom to travel the world or to pursue a passion without thinking about income. It's very much a personal definition, and that's important to remember. What feels like a lot of money to one person might feel like just enough to another, given their life's circumstances. In some respects, it is about peace of mind, too.

- Arm Tattoos For Women

- Minecraft Stickers

- Strawberry Shortcake Stanley

- Boho Box Braids

- Mark Wahlberg Calvin Klein

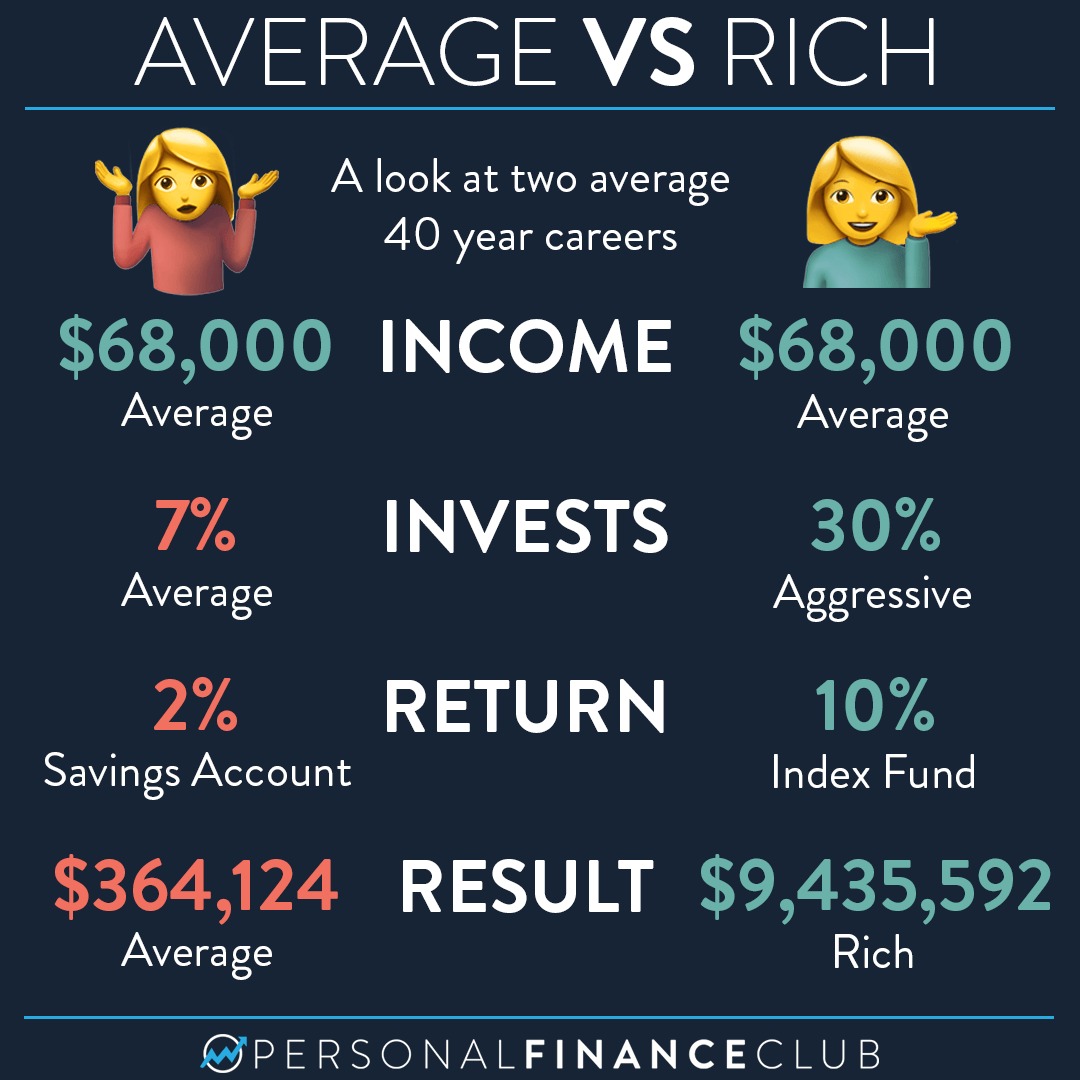

There is also a difference between having a high income and having true wealth. A high income means you earn a lot of money each year, but wealth means you own assets that can generate income or hold value over time, like investments or property. Someone with a 200k salary might feel rich if they have few expenses and are saving a lot. However, another person earning the same amount might feel quite stretched if they live in an expensive city, have many dependents, or carry a lot of debt. So, it's not just about the salary itself, but what you do with it and what you have built up over time, basically.

Location, Location, Location: Cost of Living Impacts Everything

Where you live has a massive impact on how far a 200k salary will go. A salary that feels incredibly generous in one part of the country might barely cover the basics in another. This is because the cost of living, which includes housing, food, transportation, and everyday services, varies wildly from place to place. It is a really big factor, you know?

High-Cost Areas

In cities like New York, San Francisco, or parts of Southern California, a 200k salary, while good, might not feel like "rich." Housing costs alone can eat up a huge chunk of that income. Rent for a modest apartment could be several thousand dollars a month, and buying a home might seem out of reach for many. Groceries, gas, and even a simple night out can be much more expensive there. So, while you might earn a lot, your purchasing power is a bit less than you might expect, honestly.

People in these areas often find that even with a high income, they still need to budget carefully and make choices about their spending. Saving for retirement or a down payment on a home can be a real challenge. It's a different kind of financial picture compared to other places, you know? A 200k salary in these spots might mean a comfortable life, but it probably won't mean living in a mansion or having a super extravagant lifestyle, typically.

Lower-Cost Areas

On the flip side, a 200k salary in a lower-cost-of-living area, like many parts of the Midwest or the South, could genuinely make you feel quite rich. Housing is much more affordable, and everyday expenses are generally lower. You might be able to buy a larger home, save a significant portion of your income, or enjoy a more luxurious lifestyle. This is where the 200k figure really starts to shine for many people, perhaps.

In these places, a 200k salary could mean financial freedom, the ability to invest heavily, and less stress about money. You could potentially retire earlier, send your kids to private schools, or pursue hobbies that require more funds. It's a completely different experience, as a matter of fact, and it highlights just how much location shapes your financial reality.

Family Size and Financial Commitments

Your family situation also plays a huge role in whether a 200k salary feels rich. A single person with no dependents and minimal debt will experience that income very differently than someone supporting a family of four or five. Each child brings additional costs for food, clothing, education, and activities. A family income of 200k might feel good, but it has to stretch much further. This is a very real consideration, obviously.

Think about childcare costs, which can be incredibly high, or the expenses of healthcare for multiple people. College savings, extracurricular activities, and just the general wear and tear of family life add up quickly. So, while the salary itself is high, the number of people it needs to support significantly changes how much is left over for discretionary spending or saving. It's a different financial equation, you know?

Taxes and Other Deductions: The Real Take-Home Pay

It is important to remember that a 200k salary is your gross income, meaning it's the amount before anything is taken out. What you actually get in your bank account, your net pay, will be much lower after taxes and other deductions. These deductions can include federal income tax, state income tax (if your state has one), local taxes, Social Security, Medicare, and contributions to retirement accounts like a 401(k) or health insurance premiums. This can really add up, as a matter of fact.

For someone earning 200k, the total deductions could easily be 30% or more of their gross pay, depending on their tax bracket and benefits choices. This means your actual take-home pay might be closer to $140,000 a year, or even less. When you break it down monthly, that's roughly $11,500. While still a good amount, it's a far cry from the full $200,000 you might initially think of. So, it's not quite as simple as just looking at the big number, is that right?

Debt and Financial Goals: Shaping Your Outlook

The presence of debt can significantly impact how "rich" a 200k salary feels. If you have large student loan payments, a hefty mortgage, car loans, or credit card debt, a big chunk of your income might be going towards paying those off. This leaves less money for saving, investing, or enjoying a luxurious lifestyle. It's a bit like having a leaky bucket, perhaps.

Conversely, if you are debt-free or have very manageable debt, that 200k salary provides a lot more flexibility. You can direct more money towards your financial goals, whether that's saving for a down payment on a house, building a robust investment portfolio, or planning for early retirement. Your financial goals also shape your perception. If your goal is to save a million dollars in five years, 200k might feel like a stepping stone rather than the final destination. It's all about perspective, you know?

Lifestyle Expectations and the Pursuit of More

Human nature often leads us to adjust our spending to match our income, a concept sometimes called "lifestyle creep." As your salary goes up, so too do your expectations for what you can afford. A person earning 200k might start buying nicer cars, living in a bigger house, eating out more often, or taking more expensive vacations. This can make even a high salary feel less impactful, as a matter of fact.

If your idea of "rich" involves a very high-end lifestyle—private jets, multiple luxury homes, designer everything—then a 200k salary, even after taxes, will likely fall short of that dream. However, if your definition of rich is simply comfort, security, and the ability to enjoy life without constant financial stress, then 200k could absolutely provide that. It's really about what you expect from your money, you know? It's a very personal thing, honestly.

When 200k is Just a Single Episode: A Look at Celebrity Earnings

It is interesting to put a 200k salary into a different context, especially when we look at the earnings of some public figures. For instance, my text mentions that Anna Paquin, Stephen Moyer, and Alexander Skarsgard all made $200k per episode for a show. Now, think about that for a second. That's $200,000 for just one episode of work. If a show has, say, ten episodes in a season, that's $2 million for a few months of acting. This really highlights how different income streams work, and how the term "rich" can mean very different things to different people. It's a very different scale, isn't it?

When you compare an annual salary of 200k to someone earning 200k per episode, the perception of "rich" shifts dramatically. For the average person, 200k a year is a significant achievement. For a top-tier celebrity, it might be a single payday. This comparison just goes to show that "rich" is not just about the number itself, but also about the context, the industry, and the overall wealth a person has accumulated. It's a good way to see how relative money can be, you know?

Beyond the Salary: Wealth and Assets

True financial richness often goes beyond just a high salary. It's about accumulated wealth, which includes investments, real estate, and other assets that can grow in value or generate passive income. Someone with a 200k salary who saves and invests wisely might build significant wealth over time. On the other hand, someone with the same salary who spends everything they earn might never achieve true financial independence. It's a bit like building a sturdy house versus just living in a fancy rental, perhaps.

Wealth provides a safety net and options that a high salary alone cannot. It means you have money working for you, even when you are not actively earning. This could be through dividends from stocks, rental income from properties, or interest from savings. So, while a 200k salary is a great start, the real key to long-term financial security and feeling truly "rich" often lies in how effectively you convert that income into lasting assets. Learn more about financial planning on our site, as a matter of fact.

Practical Steps for Financial Well-Being

Regardless of your salary, taking control of your finances is always a smart move. If you are earning 200k, or any amount, here are a few simple ideas to help you feel more financially secure and, perhaps, richer. These steps can help you make the most of your earnings, really.

- Create a Realistic Budget: Knowing where your money goes is the first step. Track your income and expenses to see where you can save. This helps you understand your financial picture clearly, you know?

- Save and Invest Consistently: Make saving a regular habit. Even small amounts, put away consistently, can grow significantly over time thanks to the magic of compounding. Consider putting money into a retirement account or other investment vehicles.

- Pay Down High-Interest Debt: High-interest debt, like credit card balances, can eat away at your income. Prioritize paying these off to free up more cash flow for other goals. It's a very good way to improve your financial health, basically.

- Build an Emergency Fund: Aim to have at least three to six months' worth of living expenses saved in an easily accessible account. This provides a safety net for unexpected events, so you do not have to go into debt.

- Educate Yourself: Learn about personal finance, investing, and wealth building. The more you know, the better decisions you can make with your money. You could check out resources like a reputable financial site for general guidance on money matters, for instance.

- Plan for the Future: Think about your long-term goals, like retirement, buying a home, or funding your children's education. Having clear goals helps you direct your financial efforts more effectively. You can link to this page budgeting tips for more ideas, too.

People Also Ask: FAQs About a 200k Salary

Is 200k a good salary for a single person?

For a single person, a 200k salary is generally considered very good, especially if they do not have significant debt or dependents. It allows for a comfortable lifestyle, strong savings, and investment opportunities in most areas. However, as discussed, living in a very high-cost city could make it feel less luxurious, you know? It really depends on the specific location, but overall, it's a solid income, honestly.

What income is considered upper class?

The definition of "upper class" income varies a lot by source, location, and family size. Generally, for a household, it often starts at incomes significantly higher than the median, sometimes around $150,000 to $200,000 in some areas, but often much higher in major metropolitan areas, perhaps $300,000 or more. A 200k salary for an individual could put them in the upper income brackets for many regions, but it is not universally considered "upper class" across all parts of the country or for larger families. It's a fluid term, basically.

How much do you take home from 200k after taxes?

The actual take-home pay from a 200k salary varies quite a bit depending on your state, deductions, and how you fill out your tax forms. After federal income tax, state income tax (if applicable), Social Security, Medicare, and other deductions like health insurance or 401(k) contributions, you could realistically take home anywhere from $120,000 to $150,000 annually. This means your monthly take-home pay might be in the range of $10,000 to $12,500. It's important to remember that the gross amount is not what you see in your bank account, obviously.

:max_bytes(150000):strip_icc()/GettyImages-951745458-bcfd88122f5a4d17bfda51c875f2fd7d.jpg)