Many people often wonder about the financial standing of others, especially when a name like Circosta comes up in conversation. It's a common curiosity, really, to get a sense of someone's economic position. This kind of inquiry often leads to questions about how someone might have accumulated their financial resources, what sorts of things contribute to a person's overall money picture, and the paths they might have taken to reach a certain level of economic comfort. So, we are going to look into what "Circosta net worth" might mean and the general principles behind it.

Thinking about someone's money situation, or their Circosta net worth, involves a lot more than just looking at a single number. It includes a person's earnings, the things they own, and any money they might owe. You know, it is almost like piecing together a big puzzle that shows a complete picture of someone's financial life at a particular point in time. We will explore the different elements that play a part in shaping this financial picture.

This discussion aims to shed some light on the various aspects that go into figuring out someone's money standing, using the idea of "Circosta net worth" as our main example. We will touch on how people generally build their financial reserves, what kinds of things count as valuable possessions, and the ways in which money decisions can shape a person's economic future. Basically, we will talk about the broad ideas that help us grasp what a personal money figure truly represents.

Table of Contents

- A Look at Circosta's Background - Biography

- How Does One Build Circosta Net Worth?

- What Contributes to a Person's Circosta Net Worth?

- Is Circosta Net Worth a Fixed Number?

- Common Misconceptions About Circosta Net Worth

- The Importance of Long-Term Planning for Circosta Net Worth

- Beyond the Numbers- Circosta Net Worth and Impact

A Look at Circosta's Background - Biography

When we talk about someone's financial standing, like the idea of Circosta net worth, it often helps to consider their life story. A person's background, where they grew up, and the opportunities they had can all play a part in shaping their economic journey. Think about it, early experiences often set the stage for later successes, or sometimes, for certain challenges. This is true for anyone, you know, whether they are a public figure or someone we know personally. It helps to give us a bit of a picture.

Every individual's path is unique, and that certainly holds true when it comes to how their money situation develops. We can think about the general kinds of experiences that might contribute to a person's overall financial health. For example, the type of schooling someone received, the community they were part of, and even the family values they grew up with could influence their decisions about money and work. In a way, these early parts of life lay down a sort of foundation.

So, as we consider the concept of Circosta net worth, we are really looking at the culmination of many years of choices, work, and perhaps a bit of good fortune. It is not just about what someone has right now, but how they got there. This involves looking at the general life events and decisions that contribute to a person's financial narrative. It's really quite interesting to think about the different roads people take.

- Enzo In The Vampire Diaries

- Mapa De El Salvador

- Parcheesi Vs Parcheesi

- Old Hollywood Dti

- Kindergarten Graduation

Personal Details and Early Life

To give a more complete picture of a person's financial journey, it's often helpful to look at some basic life information. This kind of data can provide context, though it does not tell the whole story. For someone like Circosta, whose financial standing we are discussing, we might consider general details that usually appear in a biography. These are the kinds of things that help us place someone in a broader context, so.

We can think about the typical information that shapes a person's early life and how it might set them on a particular path. This might include where they were born, what their initial educational experiences were like, or perhaps the kind of work they first did. These elements, while seemingly small on their own, often combine to influence later decisions about careers and money. It's just a little piece of the puzzle, really.

Here is a general table outlining the kinds of personal details and bio data one might consider when discussing a person's background, which could influence their Circosta net worth over time. These are, of course, hypothetical examples to illustrate the types of information that are often relevant when discussing someone's life story and financial development.

| Category | General Information (Example) |

|---|---|

| Birthplace | A mid-sized town in a certain region |

| Early Education | Public schooling, then a university degree in a field like business or engineering |

| First Job | An entry-level position in a growing industry |

| Key Skills Developed | Problem-solving, communication, financial analysis, leadership |

| Family Background | Middle-income household, emphasis on hard work and saving |

| Early Interests | Community involvement, personal finance, entrepreneurship |

How Does One Build Circosta Net Worth?

Building a significant amount of money, or what we are calling Circosta net worth, usually comes from a combination of earning money, saving a part of it, and making smart choices with what you have. It is rarely an overnight thing; instead, it tends to be a process that takes many years. People often start small, then gradually increase their financial resources as they move through their working lives. This takes a lot of patience, you know, and a bit of foresight.

One common way people gather their financial resources is through their chosen line of work. A steady job with increasing pay over time can contribute a lot to a person's overall money picture. Beyond that, many individuals also look for ways to make their money work for them, perhaps by putting it into things that can grow in value. This can include various types of holdings that might increase in price over time, or give back some sort of regular payment. Basically, it is about making your money do more for you.

The path to a sizable money amount, or Circosta net worth, is different for everyone, but some common themes pop up. These include consistent work, a good habit of putting money aside, and being thoughtful about where that money goes. It is also about avoiding big financial pitfalls that could set someone back. So, it is a careful dance between bringing money in and managing it well, which really is a skill in itself.

Early Career Paths and Growth

The beginning of someone's work life often sets the stage for their future financial standing, including their Circosta net worth. Many people start in entry-level positions, learning the ropes and gaining valuable experience. Over time, as they gather more skills and knowledge, they might move into roles with more responsibility and, usually, higher pay. This gradual increase in earning potential is a key part of how someone's money picture starts to take shape.

Consider the different paths people might take. Some individuals might pursue a professional field, like medicine or law, which often requires extensive schooling but can lead to very good earnings later on. Others might go into business, perhaps starting their own company or working their way up in a large organization. Each of these paths offers different ways to increase one's income over time. It is a bit like choosing a road, and some roads are longer but lead to bigger rewards, so.

Growth in a career is not just about getting a higher salary, though that certainly helps with Circosta net worth. It also involves building a network of connections, learning new things constantly, and becoming an expert in a particular area. These things can open doors to new opportunities, better positions, and even chances to start new ventures. It is about becoming more valuable in the work world, which usually translates into more money over the years.

The Role of Smart Financial Decisions in Circosta Net Worth

Beyond just earning money, the choices a person makes with their funds play a very important part in shaping their Circosta net worth. It is not just about how much money comes in, but also about how much stays, and how that saved money is put to use. Smart decisions here can mean the difference between a modest sum and a much larger amount over time. You know, it is about being a good caretaker of your own money.

One key area of smart money choices involves putting money aside regularly. This means not spending every bit of what you earn, but rather setting aside a portion for the future. This saved money can then be used for bigger goals, or to create a safety cushion. People often talk about having an emergency fund, for example, which is a smart choice that helps protect your money picture from unexpected events. That is a very sensible thing to do.

Another important part of making good money choices is being thoughtful about how you handle debt. While some debt, like a house loan, can be a part of building assets, too much high-interest debt can really slow down your progress towards a healthy Circosta net worth. Paying off debts quickly and avoiding unnecessary borrowing can free up more money to save or put into things that grow. It is about keeping your financial house in order, basically.

What Contributes to a Person's Circosta Net Worth?

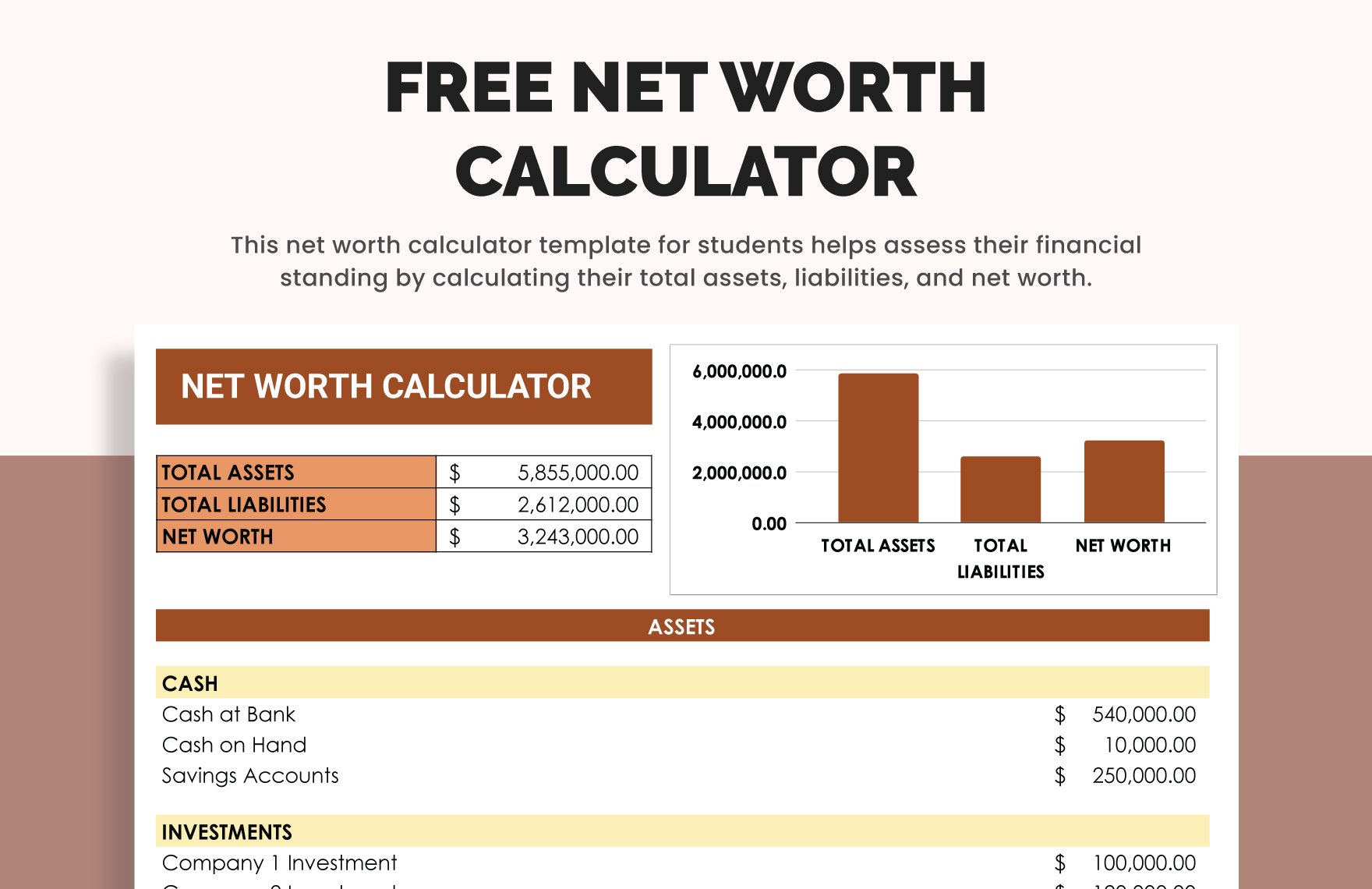

When we talk about someone's overall money standing, like Circosta net worth, we are really looking at two main things: what they own and what they owe. It is a simple equation, really. Everything a person possesses that has value, minus everything they have to pay back to others, gives you that final figure. This number is a snapshot, a moment in time, showing where someone stands financially. It can change quite a bit, you know, from one day to the next.

The things a person owns can be quite varied. This might include a home, a car, money in a bank account, or even things like valuable collections or pieces of art. On the other side are the things a person owes. This could be money borrowed for a house, a car, or even credit card bills. To get a clear picture of Circosta net worth, you need to list all these things out and do the math. It is quite straightforward, really.

Understanding these elements is the first step to making sense of any personal money figure. It is not just about the big things, but also the smaller ones that add up over time. Every little bit of money saved, every valuable item acquired, and every debt paid down contributes to the overall picture. So, it is a sum of many parts, which is important to remember.

Understanding Assets and Liabilities for Circosta Net Worth

To truly grasp Circosta net worth, we need to get a handle on two core ideas: assets and liabilities. Assets are all the things a person owns that have some sort of value. This could be cash in the bank, money in investment accounts, a house, a vehicle, or even valuable personal items like jewelry or a collection of something special. These are the things that add to a person's financial strength, in a way.

On the flip side, liabilities are the things a person owes to others. This includes any money borrowed, such as a mortgage on a home, a loan for a car, student loans, or credit card balances. These are financial obligations that reduce a person's overall money standing. It is like having a backpack full of valuable items, but also carrying a few heavy rocks that you need to put down, you know.

Calculating Circosta net worth simply means taking the total value of all assets and subtracting the total amount of all liabilities. If the assets are worth more than the liabilities, the net worth is a positive number, which is generally what people aim for. If liabilities are greater than assets, the net worth would be a negative number. This simple calculation gives a clear, though sometimes surprising, picture of someone's financial situation. It is a very direct way to look at things.

Investment Strategies and Circosta Net Worth

A significant part of building Circosta net worth often involves putting money into things that have the potential to grow over time. This is what people generally call investing. Instead of just letting money sit in a bank account where it might not grow much, people choose to put it into various types of holdings that could increase in value or provide regular payments. This can be a very powerful way to make your money work for you, basically.

There are many different ways people choose to put their money into things that grow. Some might buy shares in companies, hoping that those companies will do well and the value of the shares will go up. Others might put money into property, like buying a house or an apartment building, with the idea that its value will increase over the years, or that it can generate rental income. These are just a couple of examples, you know, of the many possibilities.

The key to smart money placement for Circosta net worth often involves thinking for the long term and spreading your money across different kinds of holdings. This helps to reduce risk, as not all things will perform well at the same time. It also means doing a bit of learning and staying informed about how different types of holdings work. It is not about guessing, but about making informed choices that align with your financial goals. That is what people usually say, anyway.

Is Circosta Net Worth a Fixed Number?

It is a common idea that a person's money standing, like Circosta net worth, is a set figure that stays the same. However, this is far from the truth. A person's financial situation is actually quite fluid; it can go up and down quite a bit, even from day to day. Many different things can influence this number, making it a dynamic figure rather than a static one. It is really more like a moving target, you know.

Think about it: the value of things someone owns can change. For example, the price of a house can go up or down depending on the market. The value of shares in a company can change every day based on how the company is doing or what is happening in the wider economy. Similarly, the amount of money a person owes can change as they pay down loans or take on new ones. So, the number is always shifting, more or less.

Because of all these changing parts, it is better to think of Circosta net worth as a snapshot taken at a specific moment. It gives you an idea of someone's financial health right then, but it does not predict what it will be tomorrow or next year. This understanding is important because it means that financial planning is an ongoing process, not a one-time event. It is a continuous effort, really.

The Dynamic Nature of Circosta Net Worth

The idea that Circosta net worth is always changing comes from the fact that its components are not fixed. A person's income can change, their spending habits might shift, and the value of their possessions can fluctuate with market conditions. This constant movement means that a person's money picture is always in motion, reflecting the choices they make and the wider economic climate. It is a very active number, you know.

Consider the impact of various life events. Getting a new job with a higher salary, receiving a gift, or inheriting money could all increase a person's assets and, by extension, their Circosta net worth. On the other hand, unexpected expenses, losing a job, or a drop in the value of things they own could cause the number to go down. These are all common occurrences that affect anyone's money situation, so.

This dynamic quality also means that people often adjust their financial plans over time. What made sense for their money situation five years ago might not be the best approach today. Staying aware of these changes and adapting to them is a key part of maintaining or growing one's financial standing. It is about staying flexible and responsive, which is actually quite important.

Factors That Can Change Circosta Net Worth

Many different things can cause a shift in someone's financial standing, affecting their Circosta net worth. Some of these factors are within a person's control, while others are external forces that everyone faces. Understanding these influences can help people make better choices and prepare for what might come. It is about being aware of the currents, you know, that can push your financial boat in different directions.

One major factor is income. A rise in earnings, perhaps from a promotion or a new, better-paying job, can significantly increase the money available for saving and putting into things that grow. Conversely, a reduction in income, or even a period of unemployment, can have a negative effect. Another personal factor is spending habits; spending less than you earn allows for more money to be put aside, which builds net worth. That is a pretty basic idea, really.

External factors also play a big part. The overall health of the economy can affect the value of things like property and shares. When the economy is doing well, these things often go up in price, which can boost Circosta net worth. When the economy is struggling, values might drop. Interest rates also matter; they can affect how much you pay on loans or how much you earn on savings. So, there are many moving pieces that influence the overall picture.

Common Misconceptions About Circosta Net Worth

When people talk about someone's money standing, like Circosta net worth, there are often a few misunderstandings that pop up. It is easy to make assumptions based on what you see or what you hear, but the full picture is usually more complex. These common mistaken ideas can sometimes lead to wrong conclusions about a person's true financial health. It is really important to look beyond the surface, you know.

One frequent mistake is equating a high income with a high net worth. While earning a lot of money certainly helps, it does not automatically mean someone has a large amount of financial resources. If a person with a high income also has very high spending habits or a lot of debt, their actual net worth might be much lower than people assume. It is about what you keep, not just what you earn, which is a key distinction, so.

Another common misunderstanding is thinking that someone who owns expensive things must have a very high net worth. While valuable possessions contribute to assets, they also often come with significant costs, like maintenance, insurance, or loans. A person might have a fancy car or a big house, but if they owe a lot of money on those things, their actual net worth might not be as impressive as it seems. It is a bit like looking at a beautiful painting without seeing the frame it is in, basically.

What People Often Miss About Circosta Net Worth

There are several things people frequently overlook when trying to figure out someone's money standing, including the idea of Circosta net worth. One big thing is the difference between having a lot of cash flow and having a lot of wealth. Cash flow is about how much money comes in and goes out regularly, while wealth is about the total value of what you own minus what you owe. You can have high cash flow but low wealth if you spend everything you get, you know.

Another aspect often missed is the impact of debt. Someone might have a lot of valuable assets, like many properties, but if they also have huge loans on those properties, their actual net worth could be much smaller than it appears. The amount of money owed can really eat into the overall financial picture, making a seemingly rich person less financially secure than one might think. It is a very significant part of the equation, really.

Finally, people sometimes forget that net worth is not just about material possessions. It also includes less visible things like retirement savings, investment accounts, and other financial holdings that might not be obvious to an outsider. These hidden assets can make a big difference to someone's overall financial standing. So, judging someone's Circosta net worth just by what you see can be quite misleading, as a matter of fact.